Dealing with a severe storm can be one of the most upsetting times in a homeowner’s life. From worrying about injuries to your family and pets to trying to salvage mementos and personal property, the aftermath of a storm can be draining. Dealing with your insurance company and finding out that your policy may not cover the full extent of your electrical repairs can make a bad experience much worse.

Complying with current building codes, especially if the house is more than ten years old, can add significant cost to the restoration of your home. If you need ordinance upgrades to your electrical system or home’s structure, you could be stuck with a hefty bill.

Are Code Upgrades Covered in Replacement Policies?

A standard home insurance policy should pay the agreed-upon cost of fixing your house. However, many plans don’t pay for ordinance upgrades, which may be required to ensure that the house is compliant with new laws.

Potential insurance gaps resulting from code compliance can be numerous. Standard replacement insurance policies may cover the cost to replace or repair the home of like kind and quality, but building code upgrades aren’t part of the standard coverage of many policies.

For example, building codes cover just about every aspect of residential construction, including:

- Electrical wiring system

- Plumbing and pipes

- Heating and air conditioning

- Setbacks from streets or waterways

- Construction materials and the means and methods of construction

Some insurance policies may provide code coverage, also called Building Code Coverage or Ordinance Coverage. The average is 10% of the policy limit. However, this coverage may not cover the full extent of the repairs required for the new structure to be code-complaint.

How Much Will Code Upgrades Cost?

Code upgrades and the cost, depending on where your home was damaged and how old the structure is. Many electricians in Wisconsin will give a personalized quote for upgrading the structure to be electrical code-compliant. Even with some building code coverage, the homeowner will still be on the hook for most of these costs.

Reading your policy carefully and talking with a licensed public adjuster to ensure that you completely understand your coverage can help. The adjuster may examine the extent of your loss and then confirm your coverage and costs. They may be able to help you with your homeowner’s insurance claim.

Some homeowners have the option of endorsing their insurance policies with appropriate code coverage, providing them the right amount of protection. It may cause the monthly premium to go up, but this may be worth the extra cost for people who own older homes.

People who have building code endorsement as part of their homeowner’s insurance coverage likely have the coverage they need to comply with the necessary building code upgrades. Make sure that your electricians in the Mauston – Tomah Area provide you with an itemized estimate of the work needed to repair your home and ensure that the wiring is in compliance. Finally, come to an agreement with your insurance carrier about how the costs will be covered before approving any repairs.

Do You Need Electrical Service in Mauston and Tomah or the Surrounding Area?

Do you need electrical service, including re-wiring after a fire or storm damage? We can help. Call the qualified team at Gray Electric today at 608-847-6209 or contact us to schedule an appointment.

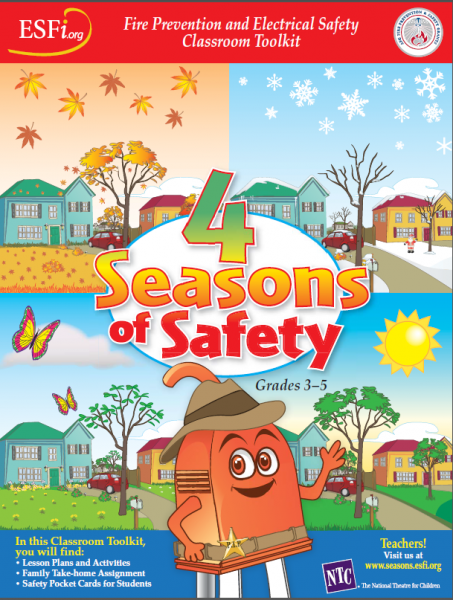

Make learning about electrical safety fun! Each season of the year has unique fire and electrical safety dangers that are related to common seasonal activities. The 4 Seasons of Safety program includes tips, lessons and activities that help students learn about basic fire and electricity concepts while also providing critical safety information that helps them learn to identify and prevent the fire and electrical safety hazards. We also encourage you to

Make learning about electrical safety fun! Each season of the year has unique fire and electrical safety dangers that are related to common seasonal activities. The 4 Seasons of Safety program includes tips, lessons and activities that help students learn about basic fire and electricity concepts while also providing critical safety information that helps them learn to identify and prevent the fire and electrical safety hazards. We also encourage you to